Unreliable Delivery Experiences Drive Consumers Back to In-Store Shopping This Holiday Season

Blue Yonder’s latest survey finds consumers wary of home delivery and expedited shipping

SCOTTSDALE, Ariz. – Dec. 6, 2023 – Blue Yonder, a leading supply chain solutions provider, today announced the results of its 2023 holiday shipping survey, which polled U.S. consumers on their anticipated holiday shopping decisions, given shipping deadlines. Despite healthy skepticism (48%) of the reliability of home delivery, most consumers (59%) plan to use online shopping for most of their holiday purchases. As for the timing of their shopping, half (50%) of respondents believe placing an online order by Dec. 15 will ensure their packages arrive by Christmas.

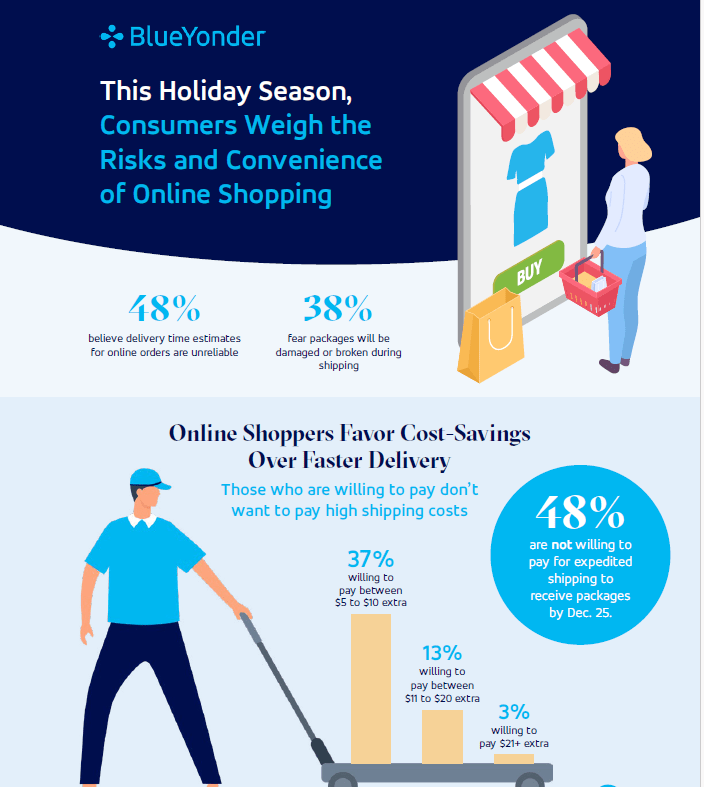

“The survey results tell us that consumers are well aware of the benefits and potential drawbacks of the multitude of shopping options,” said Shannon Wu-Lebron, corporate vice president, Global Retail Industry Strategy, Blue Yonder. “Whether visiting a store in-person, buying online, or using BOPIS (buy online, pick up in-store), consumers are thoughtfully considering several determining factors: price, convenience, and timing. Online shopping was previously considered the pinnacle of convenience; however, today 48% of consumers believe delivery estimates to be potentially unreliable and 38% are afraid their packages will be damaged en route. For some consumers, the risk is worth the benefit — others will make different choices.”

Most Consumers Favor Frugality Over Expedited Shipping

Consumer budgets continue to wield significant influence over their holiday shopping patterns. Almost half (48%) of respondents expressed unwillingness to pay for expedited shipping, favoring instead to complete their shopping well ahead of shipping deadlines. This trend was further pronounced for the Baby Boomer generation, 64% of whom were unwilling to pay for expedited shipping. Just 13% of all respondents were willing to pay between $11 and $20 for expedited shipping with most (37%) only willing to pay $5 to $10.

More than one-third (38%) reported a preference for in-store (versus online) shopping this holiday season due to more flexible return options, with 35% specifying that the availability of free in-store returns was a key priority for them.

While some consumers are willing to pay a premium for expedited delivery, more consumers overall would rather save money by personally ensuring their shopping is completed promptly.

Home Delivery May Not Be Perfectly Reliable, But It Gets the Job Done

Despite the potential for logistical hiccups, many consumers appear to have faith in home delivery. A majority (52%) of respondents said they expected any packages purchased online to arrive within two to four days of placing an order. More than 39% said they expected packages to arrive within five to seven days. When down to the wire, many consumers find online shopping to be an attractive option.

Consumers are aware of the potential downsides of online holiday shopping, but most are willing to take the risk if it’s convenient for them.

This Holiday Season, Consumers Are Prioritizing Their Own Experiences

As in previous years, the pressure is on this holiday season — and consumers will, wherever possible, opt for convenience over chaos. The majority (59%) plan to do more than half their holiday shopping online, and nearly one-third (31%) will do more than three-quarters of their shopping from home.

Even when choosing more flexible shopping options, consumers still want to avoid being inconvenienced. When asked whether they’d be willing to use alternative shopping methods like BOPIS, a plurality (45%) said they’d only do so if the pick-up location was convenient for them and 20% said they would not be willing to opt into an alternative delivery method.

Amid the holiday hoopla, consumers want to give themselves the gift of convenience — and they’ll make their shopping purchases accordingly.

As retailers navigate this holiday season, they should try to be as transparent as possible with consumers when it comes to communicating return policies and shipping deadlines. The more information customers have upfront, the better their overall shopping experience will be.

“Customer experience, which ultimately leads to brand loyalty, matters more than ever,” said Wu-Lebron. “The survey results suggest that online shopping may be waning in popularity for higher-stakes purchases. Whether through delays or damaged goods, consumers’ negative experiences with home shipping are powerful enough to drive them back into stores, which unlocks valuable opportunities for retailers.”

To learn more about how Blue Yonder helps retailers navigate and exceed customer expectations, click here.

Research Methodology

Blue Yonder collected responses on Nov. 7, 2023, from more than 1,300 U.S.-based consumers, 18 years and older, via a third-party provider for this consumer holiday shipping survey.

Additional Resources:

- Check out the Holiday Shipping Deadline Survey infographic here

About Blue Yonder

Blue Yonder is the world leader in digital supply chain transformations and omni-channel commerce fulfillment. Our end-to-end, cognitive business platform enables retailers, manufacturers and logistics providers to best fulfill customer demand from planning through delivery. With Blue Yonder, you’ll unify your data, supply chain and retail commerce operations to unlock new business opportunities and drive automation, control and orchestration to enable more profitable, sustainable business decisions. Blue Yonder – Fulfill your Potential™ blueyonder.com

“Blue Yonder” is a trademark or registered trademark of Blue Yonder Group, Inc. Any trade, product or service name referenced in this document using the name “Blue Yonder” is a trademark and/or property of Blue Yonder Group, Inc. All other company and product names may be trademarks, registered trademarks or service marks of the companies with which they are associated.

###

In The News

- Solutions Review: The Technology Transforming the Supply Chain

- Chain Store Age: How retailers benefit from new federal supply chain actions

- The Economic Times: Accenture and Blue Yonder celebrate opening of collaboration centers

- Fortune: It’s time to unshackle our supply chains

- Unite.AI: The Role of Generative AI in Supply Chains

Analyst Reports

- Gartner Market Guide for Vehicle Routing and Scheduling

- Gartner Market Guide for Workforce Management Applications

- Gartner Market Share Analysis: Supply Chain Management Software, Worldwide, 2022

- Gartner Critical Capabilities for Warehouse Management Systems

- IDC Worldwide Price Optimization and Management Application Software Forecast, 2023–2027

Media Relations Inquiries

Marina Renneke, APR

Global Corporate Communications Senior Director

Rossella Benti

EMEA Corporate Communications Director

mediarelationsteam@blueyonder.com

480-308-3037

Analyst Relations Inquiries

Celeste White

Vice President, Global Analyst Relations

analyst.relations@blueyonder.com