Blue Yonder Releases Q4 2023 Company Highlights and Q1 2024 Industry Insights

Leading supply chain solutions company grows SaaS revenue 17% year-over-year, leans into interoperability and generative AI to support customers with more resilient supply chains

SCOTTSDALE, Ariz. – Feb. 2, 2024 – Blue Yonder Holding, Inc. (Blue Yonder), a leader in digital supply chain transformation, today released its Q4 2023 and FY23 company highlights, as well as the industry trends that matter most in these early days of 2024.

Annual Company Highlights

In FY23, Blue Yonder continued to show its end-to-end strength in the market, including:

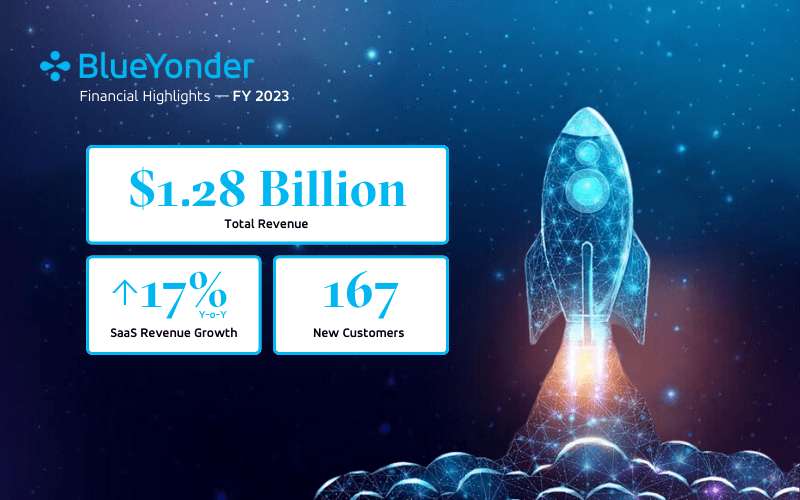

- FY23 company revenue was $1.28 billion, including 17% SaaS revenue growth year-over-year.

- Gained a total of 167 new customers in FY23.

Quarterly Company Highlights

- Added 41 new customer logos in Q4 2023. Some of the customers who selected or extended their footprint with Blue Yonder during the quarter include:

- Americas: BD, Jumex, LCBO, Mars Petcare, Penske Logistics, PVH Corp., The Hershey Company, Unicomer Group

- APAC/EMEA: Ahold Delhaize, Alfa Laval, ams-OSRAM AG, Audemars Piguet, Avon, bonprix, CEVA Logistics, Croma, Deutsche Edelstahlwerke Specialty Steel, Hotayi Electronic (M) Sdn. Bhd., John Lewis Partnership, Manufacture Francaise des Pneumatiques Michelin, Marks and Spencer, Martin Brower, Megamark, Pets at Home, Philips, Sainsbury’s, ShopRite, SICK AG

- Product innovations this quarter include:

- Interoperable Solutions: Blue Yonder released its largest product update in the history of the company in late Q4. This includes the first set of interoperable solutions across the entire supply chain – from planning to warehouse, transportation, and commerce. These solutions are delivered on the Blue Yonder Luminate® Cognitive Platform. Leaning into interoperability allows Blue Yonder to provide its customers with increased productivity, reduced waste, and more resilient supply chains. Learn more about how these interoperable solutions can help customers unlock performance and build supply chain resilience here.

- Cognitive Planning Solutions: The Blue Yonder cognitive planning solutions support supply chain leaders in achieving higher forecast accuracy, accelerating decision making, and building a more resilient supply chain with fewer resources. These microservice-based solutions run natively on the Luminate Cognitive Platform. The cognitive planning solutions are cloud-native and combine the latest data management technology with Blue Yonder’s proven supply chain planning expertise.

- Blue Yonder Orchestrator: Blue Yonder launched Blue Yonder Orchestrator, a generative AI capability that allows companies to fuel more intelligent decision-making and faster supply chain orchestration. Blue Yonder Orchestrator synthesizes the natural language capabilities of large language models (LLMs) and the depth of the company’s supply chain IP to accelerate data-driven decision-making. Integrated within the Blue Yonder Luminate® Cognitive Platform, Blue Yonder Orchestrator will be available to customers using Blue Yonder’s cognitive planning solutions. Learn more here.

- Blue Yonder acquired Doddle, a leading technology business focused on making the first and last mile more seamless, sustainable and profitable. With this acquisition, Blue Yonder offers a more comprehensive set of logistics solutions designed to build sustainable and profitable end-to-end supply chains. Learn more about how Blue Yonder can help with digital retail and omni-channel shopping journeys here.

- Showcased in 16 key technology industry analyst reports in Q4 2023, and 128 overall in 2023 – from ABI Research, Forrester Research, Gartner, and IDC, building on its industry leadership momentum (see full list below).

Industry Insights

Heading into 2024, Blue Yonder shares insights shaped by its industry expertise and trends that are top of mind for customers and partners:

- With a focus on reducing overall costs to the business, retailers will continue to emphasize driving efficiencies, reducing returns, and developing smaller locations along with increased inventory efficiency and on-shelf availability.

- Artificial intelligence (AI) is poised to have a major impact on the retail industry in 2024 and beyond; it was the hot topic at this year’s NRF Big Show. Retailers who embrace AI and use it responsibly can gain a significant competitive advantage and create a more personalized and efficient shopping experience for their customers.

- As geopolitical division continues, it will fracture global supply chain networks into regional networks. As an example, North America, Eastern Europe, and Southeast Asia will gain more manufacturing jobs and capacity at the expense of current manufacturing hubs in China. In North America, this is already playing out in increased capacity being planned in the high tech industry, specifically semiconductor and electric vehicle (EC) batteries.

- Despite the high tech industry seeing renewed manufacturing growth in the U.S., other industries, such as industrial goods, heavy duty equipment, automotive parts, and steel, are not growing as fast on the manufacturing front; however, with new investments in factories those industries may start to pick up next year. .

- Inflation brings friction between retailers and manufacturers for pricing, which began last year and is anticipated to continue in 2024 even as inflation slows.

- Warehouse vacancies are rising, which is keeping distribution center rents under control. This may allow some businesses to lease space they were previously priced out of, affording the opportunity to get closer to a highway location or one that is more in-tune with their current business mix and delivery points. And in some instances, companies may be able to negotiate for improvements or additional service, such as using vertical space and automation, and have the landlord support the financing as well, allowing them to improve their service levels and P&L from that location.

- Managing data will become much more complicated as regulatory mandates appear that prevent data from being shared outside of the region of origin (for example, these mandates are in place in China and EMEA). Global companies will need to operate separate systems by region, which will result in higher costs.

“Inflation and geopolitical tension will continue to impact supply chains in the coming year. To manage the resulting disruptions, companies need solutions that can help them process data quicker to make the best decisions that keep their supply chain running optimally. However, unlocking the value in data is a challenge for many companies when it’s spread out across the supply chain. This is where Blue Yonder is changing the game for our customers. Our new offerings will allow our customers to utilize data to quickly make recommendations, predictive insights, and intelligent decisions to build greater resilience and mitigate market volatility in their supply chain,” said Duncan Angove, CEO, Blue Yonder.

Customer Highlights:

Learn how Blue Yonder’s customers are persisting during times of disruption to digitally transform their supply chains and reimagine the consumer experience:

- City Plumbing Optimizes Warehouse Speed & Efficiency with Blue Yonder

- CPF Relies on Blue Yonder To Support Optimal Decisions (video)

- Mitchells & Butlers Optimizes Its Workforce Management With Blue Yonder

- Sainsbury’s Leverages AI and ML for Supply Chain Optimization, Enabled by Blue Yonder (video)

- Silk Logistics Optimizes Warehouse Service Levels and Costs

More From Blue Yonder:

- Technology Industry Analyst Recognitions:

- Forrester The Store Associate Tools Landscape, Q4 2023

- Forrester The Forrester Tech Tide: Smart Supply Chain, Q4 2023

- Forrester The Forrester Wave: Retail Planning Platforms, Q4 2023

- Gartner® Gartner IT Services Providers’ Performance Snapshot, 2Q23

- Gartner® Gartner Planning Solutions Systems Integrators, 2023

- Gartner® Voice of the Customer for Warehouse Management Systems

- Gartner® Market Guide for Retail Store Inventory Management Applications

- Gartner® Voice of the Customer for Supply Chain Planning Solutions Peer Insights

- IDC’s Worldwide Semiannual Enterprise Infrastructure Tracker: Workloads Taxonomy, 2023

- IDC’s Worldwide Software Taxonomy, 2023: Update

- IDC Market Glance: Generative AI Applications, 4Q23

- IDC MarketScape: Worldwide Operations Improvement Consulting Services 2023–2024 Vendor Assessment

- “Unleash the Power of Cloud: Accelerate Growth, Build Resilience, Unlock 12X Value” webinar hosted by Acceleration Economy

- Blue Yonder Survey: Returns Pose a Significant Challenge For U.S. Retailers

About Blue Yonder

Blue Yonder is the world leader in digital supply chain transformation. Global retailers, manufacturers and logistics providers leverage Blue Yonder to optimize their supply chains from planning through fulfillment, delivery and returns. Blue Yonder’s AI-embedded, interoperable supply chain solutions are connected end-to-end via a unified platform and data cloud, enabling business to collaborate in real time across functions, which supports more agile decision-making, improved customer satisfaction, profitable growth, and more resilient, sustainable supply chains. Blue Yonder — Fulfill your PotentialTM www.blueyonder.com

“Blue Yonder” is a trademark or registered trademark of Blue Yonder Group, Inc. Any trade, product or service name referenced in this document using the name “Blue Yonder” is a trademark and/or property of Blue Yonder Group, Inc. All other company and product names may be trademarks, registered trademarks or service marks of the companies with which they are associated.

###

In The News

- Solutions Review: The Technology Transforming the Supply Chain

- Chain Store Age: How retailers benefit from new federal supply chain actions

- The Economic Times: Accenture and Blue Yonder celebrate opening of collaboration centers

- Fortune: It’s time to unshackle our supply chains

- Unite.AI: The Role of Generative AI in Supply Chains

Analyst Reports

- Gartner Market Guide for Vehicle Routing and Scheduling

- Gartner Market Guide for Workforce Management Applications

- Gartner Market Share Analysis: Supply Chain Management Software, Worldwide, 2022

- Gartner Critical Capabilities for Warehouse Management Systems

- IDC Worldwide Price Optimization and Management Application Software Forecast, 2023–2027

Media Relations Inquiries

Marina Renneke, APR

Global Corporate Communications Senior Director

Rossella Benti

EMEA Corporate Communications Director

mediarelationsteam@blueyonder.com

480-308-3037

Analyst Relations Inquiries

Celeste White

Vice President, Global Analyst Relations

analyst.relations@blueyonder.com