Blue Yonder Survey: Consumers Interest in Sustainable Products and Practices Still High

Nearly half of respondents report increased interest in eco-conscious habits over the past year, but remain wary of corporate sustainability claims

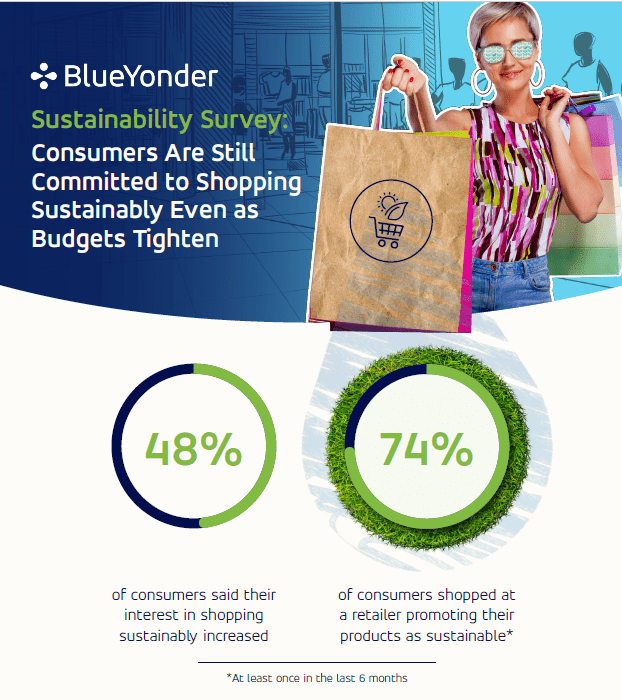

SCOTTSDALE, Ariz. – March 28, 2023 – Blue Yonder, a leader in digital supply chain transformations and omni-channel commerce fulfillment, today released the results of its 2023 Consumer Sustainability Survey, which polled U.S.-based respondents on their habits and preferences for environmentally-friendly shopping. This is the second year of Blue Yonder’s survey. By and large, consumers remain invested in eco-conscious practices, with 48% of respondents sharing an increased interest in sustainability over the past year and 44% said it remained the same. Consumers are eager to shop green where possible, even if it means paying more for certain products.

“We’re pleased to see that consumers remain as focused as ever on adopting eco-conscious behaviors, with nearly three-quarters (74%) reporting shopping at retailers with sustainable products in the last six months,” said Ed Wong, senior vice president, global retail sector leader, Blue Yonder. “It is clear that successful, environmentally friendly shopping must be driven by a symbiosis between brands and consumers. We’re deeply encouraged by how many respondents are willing to consider a sustainable product and company across resale and new product sales.”

Consumers will readily make personal sacrifices for sustainability, but to a point

Survey results indicate that consumers are willing to make personal sacrifices for more eco-friendly shopping, including paying more and delaying priority shipping. An impressive 69% said they were willing to pay more for sustainable products, but this flexibility is not without limitation; just 4% expressed willingness to pay 20% more – across age groups1. A willingness to pay 5% more was the top selection – and across all age groups. Inflation remains top-of-mind for many consumers, with 58% reporting that price was the most important factor in determining whether to make a sustainable purchase. Consumers were most amenable to paying a premium for eco-friendly products that would heavily impact their day-to-day lives, with apparel (30%), cleaning products (27%), and beauty products (19%) being the three most likely products.

While the past few years have sparked a massive influx in e-commerce, consumers are more than happy to opt for deprioritized, eco-conscious shipping speeds, and 78% would wait up to a week for a delayed delivery in favor of an environmentally friendly shipment. A whopping 86% of respondents were willing to delay their online shipping, provided they were given an incentive to do so. Of this group, 30% indicated they would wait for one week or more – up from 28% in 2022 – and with 18-29 demographic leading the way.

Brand’s sustainability claims have limited impact on consumer perception

Consumers expressed ambivalence toward corporate environmental messaging. More than half of respondents (56%) were indifferent or were not sure whether they could trust brands’ sustainability claims related to their manufacturing, supply chain, or recycling/waste practices. Rather than taking corporations at their word, consumers are more interested in hearing from their peers, with a plurality of survey respondents (32%) indicating that consumer reviews carry the most weight in their green purchasing decisions. However, consumer reviews do not carry as much weight across all age groups, with traditionalist shoppers (age 60+) evaluating the sustainability of a product on the use of recycled materials as the most important. Even with more official designations like ESG (environmental and social governance) ratings, consumers are not sold – just 14% said ESG scores were the most important determinant, and 50% were unfamiliar with ESG scores altogether.

“The survey results tell us loud and clear that brands must walk the walk, and consumers rely heavily on each other to vet corporate ESG claims,” said Wong. “The past year has also demonstrated that consumers remain sensitive to prolonged inflation, with marked shifts in their willingness to spend and a clear trend in favor of shopping secondhand. As consumers navigate and weigh their options for more environmentally-conscious shopping, we can expect to see these patterns continue across retail channels”

Other key findings:

- Resale Items: When presented with a list of consumer goods that could be purchased secondhand, household furniture and appliances, apparel, and consumer electronics – in that order – were the top three for all age groups except 18-29, which ranked apparel first. Overall, the majority of respondents (54%) said they were amenable to purchasing resale household furniture and appliances with consumer electronics coming in second with 45% indicating willingness to purchase secondhand.

- Eco-conscious Habits: Thrifting secondhand clothes remains popular, with nearly one-third (31%) of respondents listing this as the eco-conscious habit they perform most often, a marked increase from the 23% reported last year. Looking by age, those 18-29 were more likely to participate in this practice, and those 60 and older were least likely. Recycling or composting was close behind, with 28% of all respondents citing that behavior as their top practice; however, it was down from 37% in 2022. Reusable bags remains popular among shoppers, with 24% ranking that habit as their most frequent environmentally-friendly practice, the same as in 2022.

- Loyalty: The top three overall categories consumers have switched loyalty or will consider switching for are household products (65%), food products (57%), and beauty & wellness (49%). By demographics, household products ranked first for all age demographics except 60+ which ranked it second. Beauty was second for ages 18-29 while 30-44 and 45-60 ranked it as third. Only those ages 60+ ranked apparel & footwear in their top three.

Blue Yonder will be showcasing these findings and more, including how AI-enabled supply chains can save the world, at Shoptalk 2023 in Las Vegas from March 26 – 29.

Research Methodology

Blue Yonder collected responses between Feb. 17-19, 2023, from more than 1,000 U.S.-based consumers, 18 years and older, via a third-party provider for this Consumer Sustainability Survey.

1 Survey respondents were broken down by the following age groups: 18-29, 30-44, 45-60, and 60-plus.

Additional Resources

- Learn more about the Consumer Sustainability Survey results via the infographic

About Blue Yonder

Blue Yonder is the world leader in digital supply chain transformations and omni-channel commerce fulfillment. Our end-to-end, cognitive business platform enables retailers, manufacturers and logistics providers to best fulfill customer demand from planning through delivery. With Blue Yonder, you’ll unify your data, supply chain and retail commerce operations to unlock new business opportunities and drive automation, control and orchestration to enable more profitable, sustainable business decisions. Blue Yonder – Fulfill your Potential™ blueyonder.com

“Blue Yonder” is a trademark or registered trademark of Blue Yonder Group, Inc. Any trade, product or service name referenced in this document using the name “Blue Yonder” is a trademark and/or property of Blue Yonder Group, Inc. All other company and product names may be trademarks, registered trademarks or service marks of the companies with which they are associated.

###

In The News

- SiliconANGLE/theCUBE: “Road to Intelligent Data Apps” – Agentic Supply Chain Management

- Diginomica: Blue Yonder aims for ‘one speed’ supply chains with new AI and knowledge graph updatesDiginomica:

- Diginomica: Five key steps US businesses can take to prepare for tariffs

- Taking Stock With Trinity Chavez: Duncan Angove

- theCUBE + NYSE Wired: NRF Media Week – AI Retail Leaders (Duncan Angove)

Analyst Reports

- IDC Market Analysis Perspective: Middle East, Türkiye, and Africa Supply Chain Management Applications, 2024

- IDC Market Analysis Perspective: European Enterprise Applications, 2024

- IDC Worldwide Supply Chain Management Applications Market Shares, 2023: Maintained Focus

- IDC Worldwide Supply Chain Integrated Planning Applications Market Shares, 2023: Orchestration Extended

- IDC Worldwide Supply Chain Warehouse and Inventory Management Applications Market Shares, 2023: Warehouse Automation

Media Relations Inquiries

Marina Renneke, APR

Global Corporate Communications Senior Director

Rossella Benti

EMEA Corporate Communications Director

Meredith Mackintosh

NA Corporate Communications Manager

mediarelationsteam@blueyonder.com

480-308-3037

Analyst Relations Inquiries

Celeste White

Vice President, Global Analyst Relations

Sarah Hart

Program Director, Global Analyst Relations

Lindsey Hiefield

Program Manager, Global Analyst Relations

analyst.relations@blueyonder.com